Introduction

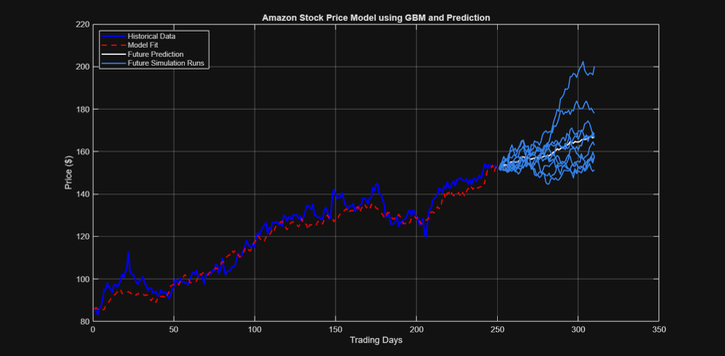

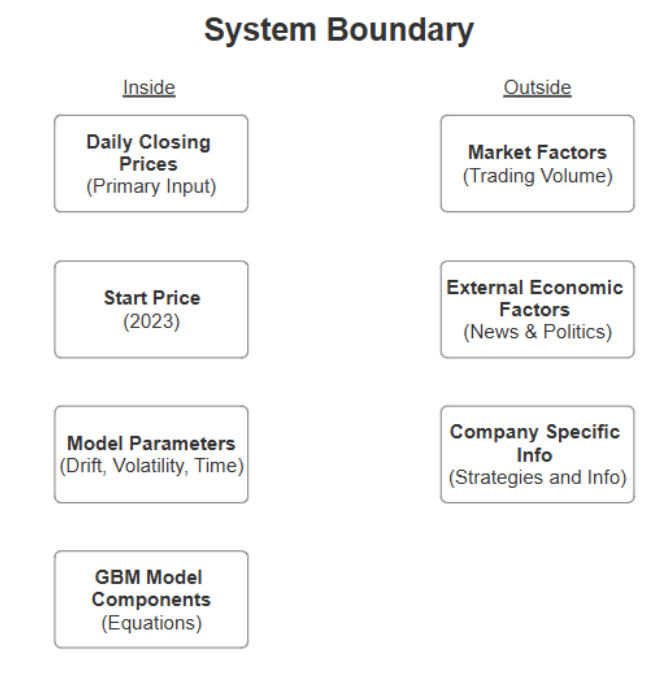

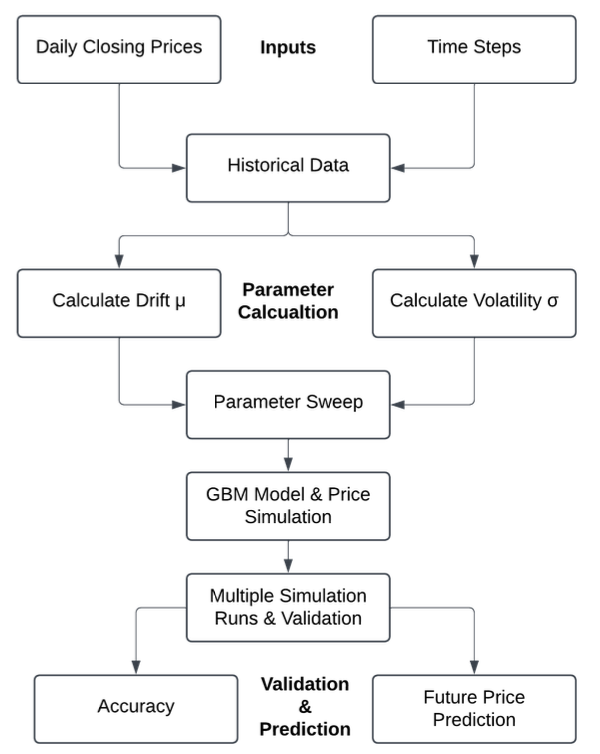

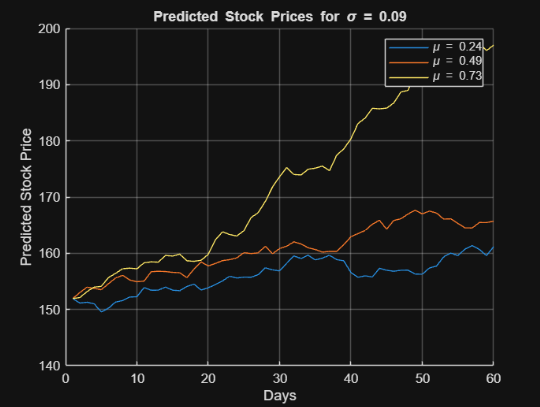

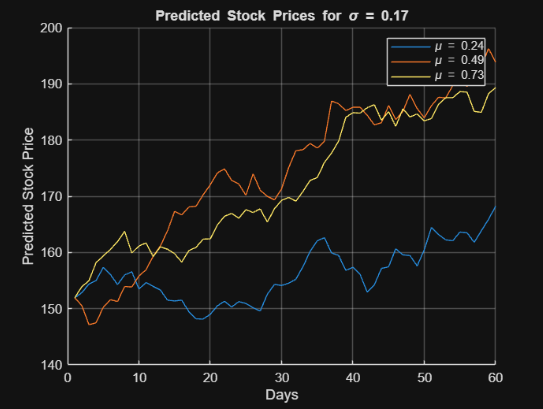

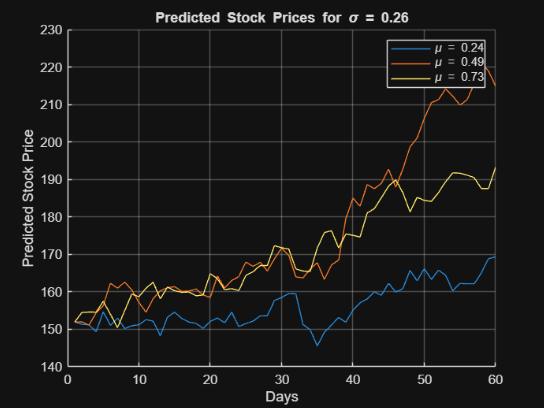

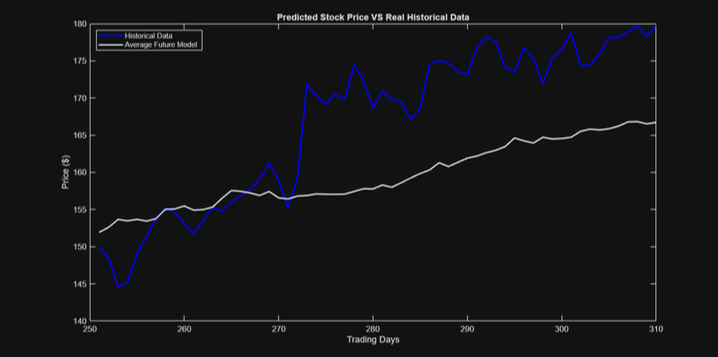

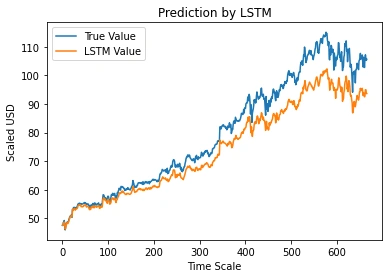

Our stock modeling project explores how effectively historical data can be used to predict future stock price movements. Using the Geometric Brownian Motion (GBM) model, we aimed to achieve over 50% accuracy when compared to historical data and investigate whether the validated model could serve as a reliable forecasting tool for future trends.